The Definitive Guide to How Do You Get A Copy Of Your Bankruptcy Discharge Papers

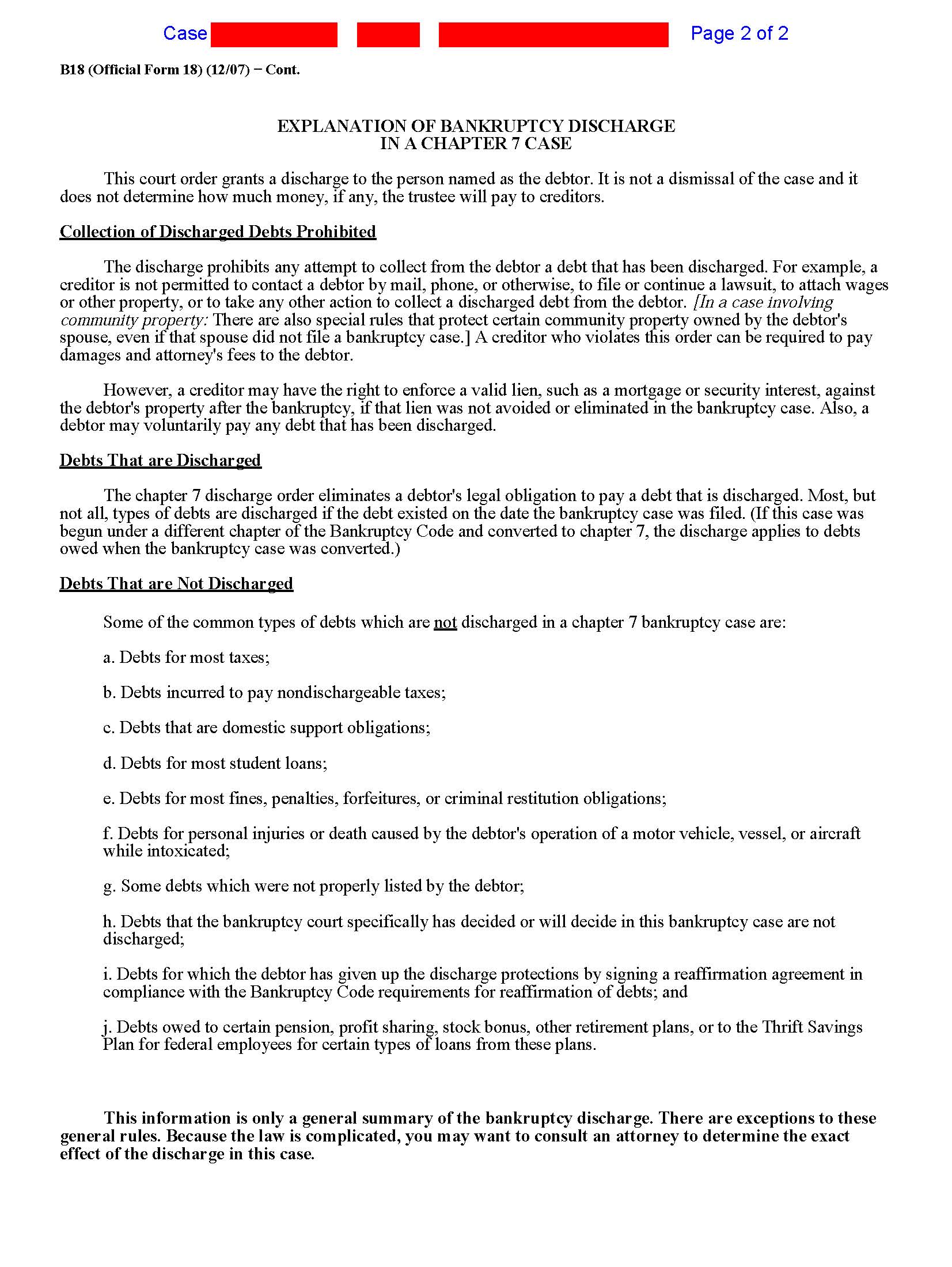

You can just receive a chapter 7 discharge as soon as every eight years. Other guidelines might use if you previously got a discharge in a phase 13 case. No person can make you pay a debt that has actually been discharged, however you can voluntarily pay any kind of financial debt you want to pay.

Fascination About Copy Of Chapter 7 Discharge Papers

Some lenders hold a secured insurance claim (for instance, the financial institution that holds the home loan on your home or the lender that has a lien on your auto). You do not have to pay a protected insurance claim if the financial debt is discharged, yet the lender can still take the residential property.

If you are an individual and also you are not stood for by a lawyer, the court should hold a hearing to choose whether to accept the reaffirmation agreement. The agreement will certainly not be legitimately binding until the court accepts it. If you declare a financial debt and after that fail to pay it, you owe the debt the very same as though there was no insolvency - https://forum.vcfed.org/index.php?members/b4nkrvptcydcp.72899/#about.

The Best Guide To How To Obtain Bankruptcy Discharge Letter

The creditor can additionally take lawful activity to recuperate a judgment against you - https://publicate.it/p/ngUqAy9G6wrl299199. Modified 10/05.

To request court records online, please complete the type listed below (https://www.merchantcircle.com/blogs/copy-of-bankruptcy-discharge-papers-baldwin-md/2022/7/Some-Known-Incorrect-Statements-About-Chapter-13-Discharge-Papers/2266396). If you are requesting to evaluate court documents at the court house, you will be called when the case documents is readily available to evaluate. If you are asking for to buy copies of court documents, you will be called with cost and also a shipment time quote.

Do NOT send your social safety and security number, bank or charge card details through this site. The clerk can not assure the safety of information or records sent out through this site. Furthermore, any kind of correspondence, documents, or files sent out to the clerk via this website might be disclosed according to Florida's Public Records Law.

Rumored Buzz on How To Get Copy Of Bankruptcy Discharge Papers

A Chapter 13 bankruptcy discharge is an extremely powerful thing. It stops your financial institutions from going after released financial obligations completely. But it can likewise be puzzling. obtaining copy of bankruptcy discharge papers. Let's respond to a few of the typical questions regarding the Phase 13 discharge. A "discharge" is the expensive legal term for your debts being forgiven in your bankruptcy.

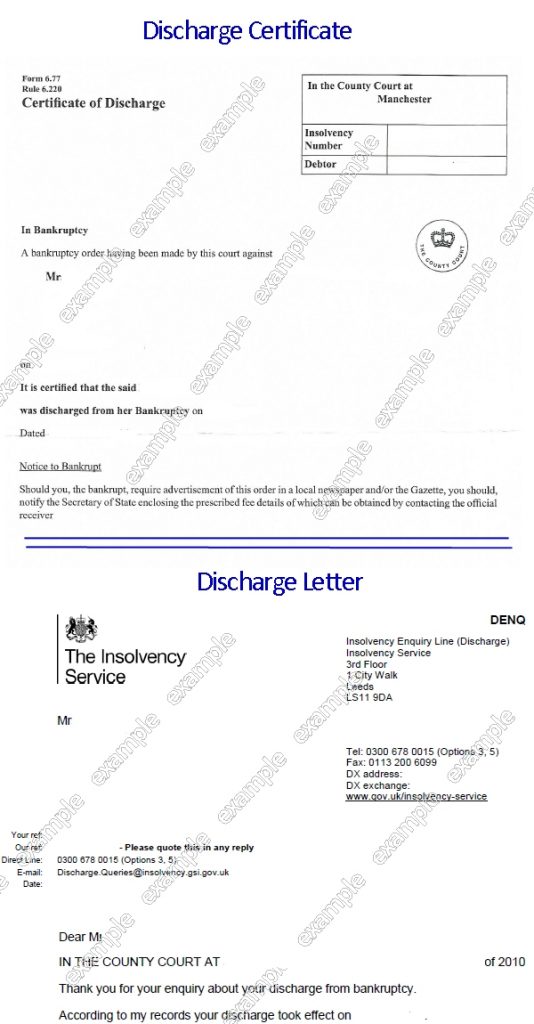

The Phase 13 "discharge order" is the last order you obtain in your Phase 13 personal bankruptcy. It is signed by the insolvency judge assigned to your situations as well as states plainly that you have actually obtained a Phase 13 discharge. Simply put, it is the formal document that releases you of your financial obligations.

We need to keep in mind that there are 2 sorts of discharge under Phase 13. The very first is the ordinary discharge given upon conclusion of strategy payments. This is called an Area 1328(a) discharge. The 2nd is called a "challenge discharge" and is in some cases called an Area 1328(b) discharge. The hardship discharge is far less common.

Indicators on Chapter 13 Discharge Papers You Should Know

While every court is slightly various, the Phase 13 discharge order looks comparable. It is signed by a judge and also states that "A discharge under 11 U.S.C. 1328(a) is provided to: Your Name". Once you obtain your discharge, your financial institutions are "enjoined" from seeking the debt. That means that the court has actually purchased them to quit collection activity.

We generally see this in situations where financial debt collection companies continue to send out repayment needs even though the person got the discharge. One Extra resources of the best things concerning bankruptcy is that your financial obligation is released tax totally free - how to get copy of bankruptcy discharge papers.

You would certainly have to pay tax on any kind of money forgiven by the financial debt enthusiast. In insolvency, the discharge makes it so that the financial debt forgiveness is not taxed. This happens. It's an audit problem for the creditor. No worries. You can just finish an IRS Kind 982 when you complete your income tax return to explain you have a bankruptcy discharge.

4 Easy Facts About How To Get Copy Of Bankruptcy Discharge Papers Explained

If we file your taxes for you, we will certainly do this for you so you don't have to fret about it. We discuss the timeline in the Chapter 13 insolvency procedure, but usually, you will obtain the discharge order about 1-3 months after completing your Chapter 13 strategy repayments. The size of your Phase 13 strategy differs from situation to instance.

Most financial obligations are dischargeable in Phase 13 with a couple of exceptions. We usually begin by thinking the financial debt is dischargeable unless an exemption applies. The common exceptions to dischargeability are: The Chapter 13 discharge is far extra comprehensive than the Chapter 7 discharge. Even more debts are dischargeable in Chapter 13 than in Phase 7.